Research Insights

More Evidence That Vertical Integration Increases Market Power and Pricing

Why This Study Is Important

Vertical integration among providers of complementary health care services has the potential to improve productive efficiency, but may also increase participants’ market power and be anticompetitive. A growing body of empirical evidence finds higher prices associated with physician/hospital integration, consistent with the hypothesis of enhanced market power. This new study extends that evidence by examining for the first time the impact of practice integration between physicians of complementary specialties. Its findings support the hypothesis that multispecialty practice can also convey pricing market power to participating physicians.

What This Study Found

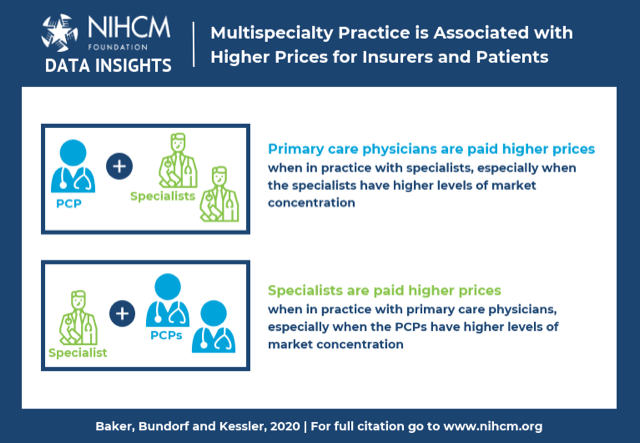

- Controlling for the level of generalist market concentration, average prices paid by commercial insurance to generalist physicians are higher when the generalists are integrated into a practice with specialist physicians, and this price effect is larger when their partner specialties enjoy a higher level of market concentration.

- These relationships work in the opposite direction, as well: controlling for specialist market concentration, average prices paid to specialists are higher when integrated with generalist physicians, and this effect is stronger when generalist market concentration is higher.

- Specialists integrated with other non-generalist specialties also have a pricing advantage that is stronger when their partner specialties have more market power.

- The fact that the market concentration of the complementary specialty is associated with higher prices for the other partner in the multispecialty practice makes it unlikely that the pricing differences are attributable to higher quality in multispecialty practices. For that to be the case, any quality advantage from multispecialty practice would have to be systematically larger when the complementary partner’s market was more concentrated.

- For both generalists and specialists, the pricing advantage conveyed by multispecialty practice integration declines when their own-specialty market concentration is higher.

What These Findings Mean

The majority of physicians now work in a multispecialty practice and the share is increasing. All results from the empirical models estimated in this paper are consistent with there being a pricing advantage when physicians integrate into multispecialty practices and are inconsistent with an explanation positing that the higher prices charged by members of these practices reflect unobserved quality benefits arising from the integration. Together with prior evidence on the anticompetitive impacts of physician/hospital integration, this new work provides added impetus for stepped up antitrust scrutiny of all forms of vertical integration, whenever complementary providers of health care services join forces.

More About This Study

This study uses 2008-2012 commercial claims data from the Health Care Cost Institute to construct ZIP code-level price indices for office visits to generalist and specialist physicians and Medicare claims to identify physicians practicing together and compute the prevalence of multispecialty practice integration and the extent of concentration in generalist and specialist markets for each ZIP code and year. Regressions with interaction terms were estimated to determine how generalist/specialist prices varied with own-specialty market concentration, integration into a multispecialty practice, and the incremental effect of integration when the complementary specialties in the practice have more concentrated markets. The models also controlled for time-invariant differences across zip code and specialty and for time trends.

Baker LC, Bundorf MK and Kessler DP. “Does Multispecialty Practice Enhance Physician Market Power?” American Journal of Health Economics, 6(3):324-47, Summer 2020.

More Related Content

See More on: Cost & Quality | Provider Consolidation